Category Archives: Company News

September Market Predictions: Will It Bounce?

August certainly lived up to its reputation for being a volatile month for investors when Bears clearly regained control. After a large rally in July, many were left disappointed by the following month’s market performance. In last month’s article, we discussed there were some favorable signs the market was beginning to stabilize. However, one major potential hang up would be “if the Federal Reserve comes back needing to be more aggressive with rate hikes”. This played out on August 26th when Jerome Powell stated there was more “pain to come” speaking about ongoing inflation management and the need to continue to be aggressive with rates and monetary policy. Markets sold off steeply that day and have struggled to recover since. The S&P is currently down nearly 7% since that Powell’s address. So what now?

This time last month markets were significantly overbought, and we thought at least a pullback would occur to help burn off some of the excess in markets. Currently, the opposite is true. Markets are broadly oversold and so it would not be unexpected to see a bounce in the near term. What is not clear is if any reflexive rallies will be able to hold or if they will eventually give way to a lower low. We have currently fallen below our short-term support levels (50 Day Moving Average) once again with the market movements of the past two weeks. If we can reclaim the 50 Day, this could potentially allow markets to resume their moves higher once again. With markets being oversold, this is a possibility. But we also must acknowledge that there is still elevated risk within markets and we could still see movements lower from our current vantage.

What’s the takeaway for investors? If you are considering making major portfolio changes now, it could be advantageous to speak to a fiduciary investment advisor before making any adjustments. When emotions are the catalysts for changes, the results aren’t always what we had hoped for. Rather, we should be looking at our portfolio allocations as carrying out specific roles in our overall investment plan. Speak with a Fiduciary Advisor to make sure each allocation has been assigned a specific role and if they are no longer meeting their function then you may want to consider replacing them. Also, it is important to remember your time horizons for your accounts. Accounts with a longer time horizon can afford to take on more volatility. Conversely, if you know you are going to need a large portion of your account in the near term, you probably want to be invested more conservatively to limit volatility when possible. If you have specific questions about your accounts, we are happy to help anyway we can!

In a bit of good news, we did release our first “Summer School” video series in August. Our first videos feature local experts in the area of credit and debt repair, real estate, and mortgage and refinancing. Here is my most recent market update and you will find all the Summer School videos hosted in the same channel.

We will be releasing new informational videos this fall and winter so stay tuned! In the meantime, enjoy the rest of your September. See you next month!

ASHLEY ROSSER, PRESIDENT

ASHLEY ROSSER, PRESIDENT

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.

Does Your Dental Practice Have an Exit Strategy?

Does your dental practice have an exit strategy? Many do not. As a business consultant and financial advisor, I have learned many strategies to help business owners and their families navigate difficult decisions. One such decision is, “what am I going to do with my business?” “Should I keep it and pass it down to my heirs, or should I sell it?” This Keep/Sell scenario usually plays out before any planning is thought through and implemented. There never seems to be enough time; business owners are typically too busy running their day-to-day operations. In my experience, I have seen several business owners pass away or become totally disabled prior to any plan execution, leaving the family and employees scrambling to keep the business profitable. As the

American poet, Henry Wadsworth Longfellow, once said:

“Great is the art of the beginning, but greater is the art of the ending.”

I was recently in Nashville TN at a business conference where I was introduced to a gentleman and his process of helping General Dentists/Business Owners with the problem of practice value; that is: “how to increase their practice value.” I was intrigued by the process. He stated the possibility of growing the practice with the added dimension of creating an exit strategy for the dentist. I have experience in this area, as I had helped the majority shareholder of a Dermatology practice with a successful exit strategy; however, this process was unique.

The strategy and process of increasing dental practice/business wealth was developed by Matt Kennedy of Dental Impact. As both the COO of a multimillion-dollar dental practice and a published author on the subject, Matt has developed a process that is simple, transparent, and effective. Having spoken to several dentists in the tristate area, I know that they are often approached by both their dental association and independent financial advisors regarding numerous financial subjects. However, I urge all who are reading this to keep an open mind and set 15 minutes aside to hear about Matt’s value proposition. To a general dentist or business owner, that 15 minutes could put $5-7 million dollars back into one’s retirement.

His proven process begins with “The Efficiency Accelerator” in which he uses a “Profit Scorecard”. In other words, he analyzes the business’ Profit & Loss Statement (P&L) along with their Personal Balance Sheet to find money they may be losing. Typically, millions are recovered over one lifetime.

“The Capacity Builder” is another step within Matt’s process. Using the “8 Driver of Practice Value” as a guide and “The Dental Freedom Code” to measure progress, dentists and business owners can see and capture the untapped potential of their practice, enabling them to get out of the dental chair or office.

Instead of an Exit Strategy, they’ll have a practice/business Options Strategy. If the choice is made to sell, one can sell up to 10x the current value. They also have the option to keep the practice and enjoy the profits without all the work. Or, ultimately, the choice could be made to pass the business down as their legacy.

A dental practice or business will be one of the most valuable assets one owns. Matt’s approach demonstrates how to take the outflows and redirect them back into the business. This will create more wealth and security in one’s retirement.

*Claim your free copy of Matt’s book, “Designing Dental Wealth” by emailing jacobr@victoryfiducairy.com. Please provide your name, address, and phone number and a copy will be mailed to you.

JACOB Riloff, Chfc, Casl

JACOB Riloff, Chfc, Casl

Jacob is the Strategic Consultant at Victory Wealth Partners. In that capacity, he specializes in business development issues for closely held businesses and their owners. He is an expert in business succession planning, exit strategies and advanced insurance planning techniques. Jacob focuses on providing business owners with sound planning to increase shareholder value in their privately held businesses. He has over twenty years of experience as a business-planning advisor.

August Market Predictions: The Seesaw Continues

Will the summer rally that started in July continue to pick up steam or will August cool off for investors? Markets were extremely bearish, extremely oversold, and were overdue for a counter rally after the steep selloffs experienced in May and June. We finally saw the expected rally in July where the S&P 500 rose over 8%. We also began to see a rotation from areas of value to areas of growth. Particularly to note, technology stocks have been making a large move off their bottom. Technically, we are currently trading two standard deviations above our moving averages. This means markets are currently overbought and will need to either have a slight pullback or at least trade sideways until some of the overbought conditions can be worked off. In other words, don’t be surprised if markets stagnate for a bit as markets do not typically move straight up. Currently the S&P 500 is finally trading above its 50-day moving average and this is now the current support line. If we can hold above this line, even during pullbacks this would be an encouraging sign that market strength is returning. Market breadth is also returning as currently 36% of funds in the NYSE are currently experiencing new highs versus new lows. That number was as low as 4% in June.

What does this mean in English? I believe the signs are reassuring that markets could continue their move higher. Potential hang ups for the market would be if inflation numbers continue to rise unchecked, or if the federal reserve comes back needing to be more aggressive with rate hikes. So far, earnings reports are showing weak earnings but “not as bad as expected” so markets are considering that a win. I would expect any unexpected weak economic data that has not been priced in could temporarily cool down the market response. We will be hearing more about July’s economic numbers in the coming days. I think any positive news could add to the current rally’s fire.

What should investors consider as we wait to see which way the market moves? Often, we can see major market rotations when we come out of a significant correction. What was working a few months ago may not continue to work once the dust has settled and new market leaders emerge. Don’t be afraid to cut out allocations that are no longer performing their role. Remember, every holding should have a defined purpose. When the market has truly bottomed, and we are on our way to a new bull cycle you want to be properly positioned to capture the current areas of strength and momentum. If you aren’t sure if you are properly allocated, this could be the right time to speak with a fiduciary financial adviser to make sure you are stacking the odds in your favor. No one knows what the market’s next move will be, we can only try to be properly prepared for what might come next.

As we enter in the last month of summer, we have been working hard taping and editing our first “Summer School” series. We have worked with leaders in the mortgage, real estate, debt management and estate planning fields to bring timely relevant content to our YouTube channel. It will be live in the coming weeks, and we hope you check it out. I also record monthly market update videos for our Youtube channel. You can watch our most current video below!

Until next month, enjoy these last weeks of summer. As always you can call me with any questions. We are happy to help.

ASHLEY ROSSER, PRESIDENT

ASHLEY ROSSER, PRESIDENT

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.

July Market Predictions – Prepare for the Dog Days of Summer

As we enter the dog days of summer, the stock the market continues to cool off substantially. This is due in part to the looming risk of recession that seems to look more likely as we march on to the third quarter. In fact, it seems like it’s a constant barrage of bad news. Surging inflation, aggressive fed rate hikes, reduction of the Fed’s balance sheet, lack of government stimulus, rising inventories, weakening retail sales, declining real disposable income, high gas and food prices weighing on consumption. The list goes on. More economists are now predicting not “if a recession is imminent, but rather how hard the landing is going to be.” Investors are hoping for confirmation that recession risk has been fully priced in currently, but we could likely see more negative pressure in the near term as price/earnings ratios finally start to reconcile. I know that’s not what we necessarily want to hear but it’s important to be realistic when managing one’s expectations.

You may be wondering how to invest when preparing for a possible recession. I think it is important to keep in mind that sometimes volatility is a necessary part of the investment cycle. What tends to catch investors off guard is when what used to work stops working. This is where your investment management strategy becomes very important. If you do not have a formal plan, this is a great opportunity to consider hiring an investment fiduciary to look over your current portfolio and make sure your allocations are set up to work for you and not against you. You should consider what types of companies are in your line up. Do they have consistent earnings? Are they quality companies? Are they fundamentally sound? We are coming out of a time where it seems every company had its stock run up, regardless of price to earnings ratios but that is now changing. You should understand what role each of your portfolio allocations has been assigned and be prepared to replace them if they are no longer satisfying that role. Education is key when it comes to investing, especially when preparing for the potential of a down market or recession.

Speaking of education, I am so excited to announce our first ever “Summer School” educations series that will be launching on You tube in a few weeks. We have been collaborating with local expert professionals in our studio to deliver a series of topics that we believe will be pertinent and relevant to many of our clients and followers. Topics covered include but not limited to debt and credit management and repair, estate and long-term care planning, current mortgage landscape as well as special planning considerations during periods of rising mortgage rates, as well as an overview of the current real estate environment and how to create wealth despite headwinds. Be sure to follow us on Facebook and You tube so you know when a new session has been released. You are not going to want to miss this! Until next time, stay safe and have a wonderful July.

ASHLEY ROSSER, PRESIDENT

ASHLEY ROSSER, PRESIDENT

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.

June Market Predictions: Some Encouraging Signs

May marked another month of wild swings in the stock market. By mid-month many investors were sitting on 10% losses in their portfolios and we began to hear the term “bear market”. Investor sentiment was exceedingly negative. A strong six day rally in the final days of the month stopped the bleeding finally and the major indexes all closed close to where they started. It was another episode of Mr. Toad’s Wild Ride stock market edition.

Does this mean the sell-off is over or was this just an example of a “bear market rally”? It is probably too soon to tell. The good news is that the current rally movement has pushed markets back to their first line of support (the 20 day moving average) and we are now approaching the 50 day moving average. In other words, markets may have found a short-term bottom. Price momentum seems to be improving. Stocks have begun to set more 52 week highs than lows (a sign of improving markets).

That being said, we are still in a fairly defined downward trend since January which means there could still be additional bumps along the road. Inflation remains an issue. Gas prices remain high. Recent weak economic data points to additional fractures in the economy. Retail consumers sentiment remains extremely pessimistic. Credit card balances increased last month pointing to trouble for the average American consumer. The adage goes “so goes the consumer, so goes the economy”.

So what should investors do considering what we know? As I always say, if you have been extremely uncomfortable over the past few months you should consider if you have too much risk in your portfolio. Talk with a financial fiduciary to help you determine what your current risk tolerance is and what an appropriate asset allocation should look like. Its ok if you decide your risk tolerance has changed by the way. Your willingness to take on risk can and SHOULD change over time. The important thing is that your portfolio pivots to accommodate any changes. Make sure your portfolio allocations are all still achieving their desired purpose. If you do not have a formal investment strategy, consider talking to a qualified fiduciary who can help you formalize your investment process. It is never too late to make sure your portfolio is working as hard as possible for you! If you have any questions, we are always happy to help!

ASHLEY ROSSER, PRESIDENT

ASHLEY ROSSER, PRESIDENT

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.

May the Fourth Be with You!

It’s May the Fourth Day and its yet time again for the Bank of the Empire (Federal Reserve) to meet this afternoon. Top on its list of discussions is the interest rate hike schedule for the rest of the year as they are widely expected to raise interest rates by half a percentage point — the largest rate hike in more than two decades. It seems like the federal reserve has certainly used its own Jedi mind tricks for the past year and half as it has tried to tamper surging inflation while also trying to be gentle to the fragile economy as we emerged from the pandemic. Investors have been understandably rattled as they weigh the implication of a rising interest rate environment versus unchecked inflation. The fed is expected to hike interest rates even higher to bring inflation back from levels we haven’t seen in decades. It’s a hugely consequential policy decision that will affect virtually everything in the economy. The stock market is already having its worst start to the year since 1939 with the S&P 500 being down over 13% as of the end of April. Hiking rates is only making investors more antsy.

The Federal Reserve will raise interest rates by raising the federal funds rate. This is the average interest rate that banks pay each other for overnight loans. By raising the cost of borrowing between banks, the increased costs associated are passed along to consumers and seen in interest rates increasing. Investors are feeling much like when Luke Skywalker said to Obi-Wan- “I got a bad feeling about this”. A rising interest rate environment can negatively affect a company’s bottom line earnings, which can quickly lead to decline in valuation. Bonds are particularly sensitive to interest rate changes. When the Fed increases rates, the market prices of existing bonds immediately decline. That’s because new bonds will soon be coming onto the market offering investors higher interest rate payments. Businesses and consumers will likely cut back on spending when the cost to borrow money rises.

If raising interest rates feels like something that comes from The Dark Side, why are they doing it? The implications of leaving rock bottom interest rates are that eventually inflation begins to run unchecked. We have seen the effects this year at the grocery store, the gas pump, and department stores as prices have surged in many sectors. This is after the sugar rush frenzy that occurred after billions of dollars of stimulus hit the economy as interest rates remained in the historical lows. It was a perfect storm for inflation to eventually begin to run hot. The Fed’s intent in raising rates is to discourage spending just enough to bring down inflation, without tipping the economy into recession — what economists call a “soft landing.”

As you can see, the Federal Reserve must constantly balance the widespread implications of their policies. Today, they are meeting to discuss the aggressiveness and timing of future rate hikes. I am not a Jedi master; however, I think it is reasonable to expect continued volatility in the stock market as investors grapple the short and intermediate affects that a rising interest rate environment can bring. In the meantime, this could be a good opportunity to review your current portfolio. Some areas of the market tend to do very well or very poorly in rising interest rates, so you want to make sure your current allocations are still performing their intended purpose. As always, we are happy to help you, especially during these uncertain times. As Yoda once said “In a dark place we find ourselves, and a little more knowledge lights our way.

May the Fourth Be With You!

ASHLEY ROSSER, PRESIDENT

ASHLEY ROSSER, PRESIDENT

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.

Will April Bring Bulls or Bears to the Stock Market?

We all know that April showers bring May flowers. What investors are wondering is if April is going to bring the bulls or the bears to the stock market. As been the case lately, either could make an appearance. We have seen the major indexes show sharp rallies since the market lows in February. This was not unexpected as markets were sharply oversold on nearly every signal. As we have previously discussed, you can only stretch a rubber band so far before it snaps back in the opposite direction just as hard. However, since markets have rallied over 5% off the bottom we are now over bought in most areas for the short term. The good news is that we are now sitting above short-term moving averages. If the market can work off the overbought condition without violating support, the bulls could certainly regain control of the narrative. There is also additional support for a continued bull rally. Higher interest rates will cause bond yields to go down, which will lead to more flows into equities as they are the only alternative to low yields. Historically, the month of April is typically a strong month for stock market return.

This doesn’t mean the market does not still have the potential for challenges ahead. Inflationary pressures can eat away at corporate growth causing earnings to fall. We are seeing the effects of the massive surge of liquidity that was poured in the economy during 2020. While it provided a short-term sugar rush to the economy, we are now seeing inflation surge with no end in sight. As inflation remains unchecked, slower economic growth could lead to continued declines in stocks. The Federal Reserve is raising rates this year, which will cause the cost to borrow money to increase further threatening bottom lines for some companies. Geo-political risk remains elevated and could cause short and intermediate term volatility.

Investors may be scratching their heads asking what side do they fall on? The good news is that you don’t need to pick a side. Investors can take prudent steps while we wait to see what markets will do in both the short and long term. This is a good time to review your asset allocations. If something isn’t working now, you may consider reallocating. Make sure you or your investment manager has clear buy and sell rules for your portfolio. You should have an identifiable exit plan for times when markets or sectors reverse. If you are uncomfortable with current volatility, consider if you are invested appropriately. Taking on more risk than necessary pays off, until one day it doesn’t. This is a good time to perform your own risk assessment. We are happy to speak with you if you have questions about your current investments. No one knows what the future will bring, we can only take educated guesses. However, it seems both the bulls and the bears are going to continue to play tug of war as we head into Spring. As always, if you have questions we would love to help.

ASHLEY ROSSER, PRESIDENT

ASHLEY ROSSER, PRESIDENT

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.

Historic Trends in Market Volatility and Global Instability

We have all been watching the tragic events in Ukraine unfold. Our hearts and prayers are certainly with all the innocent lives being affected and praying that resolution will be found quickly and peace will be restored.

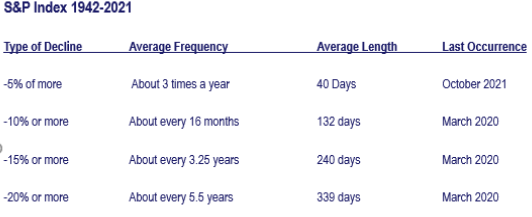

It is no surprise that we have seen the global financial markets experience increased volatility since the invasion began. If you follow Ashley’s videos you will know markets were extremely deviated from their long-term moving averages and were well overdue for a pullback as we entered 2022. Markets have been under pressure since January as they tried to grapple with rising interest rates, inflationary pressures, slowing economic growth, and disappointing earnings growth. Geopolitical instability just threw gasoline on an existing fire. I have attached a chart that shows the history of market corrections and how often investors should be prepared for 5% ,10% and even 20% corrections over time.

Historic Trends in Market Volatility and Global Instability

Markets are holding up well considering the current circumstances we are experiencing. The S&P 500 is currently trading above the October 2021 lows when we experienced a near 5% decline. We just haven’t really gone anywhere since October 4th trading sideways with bouts of high volatility. There are additional headwinds markets will need to contend with over the next few months, but the biggest concern remains the Federal Reserve’s next steps. Despite the recent correction, the markets remain convinced the Fed will hike a minimum of four times in 2022 and further in 2023. At the same time, the liquidity support from ongoing “Quantitative Easing” programs will reverse. However, if the Federal Reserve decides to be less aggressive with either considering the current level of volatility, markets will likely see at least short-term rallies. Markets are significantly oversold on nearly every level and so bounce in positive performance would not be unexpected.

Considering everything we know, what should investors do right away? In short, nothing. Notably, geopolitical events have only minor impacts on markets and tend to be short-lived. Therefore, making significant changes to portfolios based on geopolitical events has generally not worked out well for investors. I would warn if you have been feeling uneasy during the last two months it could be a sign you are invested too aggressively. You could use any upcoming rallies to reduce equity exposure and rebalance your portfolio. As mentioned above, there are still headwinds to contend with outside of the Russian Ukraine invasion and they will likely be present for the foreseeable future. You can also watch Ashley’s youtube video https://youtu.be/VJkxic3CbW0 as she discussed charts looking back at the last Ukrainian invasion in 2014 and how markets responded then. During that time, markets had been under pressure even before the invasion. The bottom of the market came the day of the invasion, and a strong rally began the very next day and lasted for months. No one can say if we will see the same this time, but history does have a habit in repeating itself. For now, our hearts and prayers are with Ukraine and the innocent lives being affected by this tragedy. If you have any questions, please do not hesitate to contact us, we are always here to help.

ASHLEY ROSSER, PRESIDENT

ASHLEY ROSSER, PRESIDENT

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.

February 2022 – Expect The Wild Ride to Continue

January’s stock market action felt a little too much like Mr. Toad’s Wild Ride. Investors endured head spinning volatility at times, particularly towards the end of the month. From Monday January 24th through Friday January 28th the S&P increased or fell by over 100 points, within 24 hours, seven times. Some of those fluctuations were closer to 200 points. The technology heavy Nasdaq index was down five straight weeks (16% from its highs) which is its longest losing streak since 2012. Small caps were down a jaw dropping 22% off their highs and have closed in a technical bear market. If you read last month’s blog So Goes January, So Goes the Year? you are wondering if markets have priced in the bottom or if more losses are on the horizon.

I would like to start off by saying that market pullbacks and corrections (while painful in the short term) are necessary parts of normal market cycles. In a normal market environment, we can expect the S&P 500 to decline 5% or more about three times a year. 10% corrections occur about every 16 months. The last major pullback for the S&P 500 was in September 2021 when it slumped 5.2% before rocketing back to close out the year. Investors are asking if we have reached the bottom of the current sell off, or if there is more downside pressure looming.

As usual the consensus is a mixture of good and bad news. The market most recently began trading in a very tight range between previous bottoms and the tops of recent bounces. The good news is that buy signals are in place, and support levels are holding. The not-so-good news is that a violation of current support could certainly lead to a deeper decline. Fourth-quarter GDP rose 6.9%, well above expectations of 5.5%. The gains were driven by a pickup in consumer spending and a surge in inventories as rising inventories contributed 4.9% of the 6.9%. The sharp rise in inventories is a good sign that some of the supply shortages are going away, but this growth will be hard to sustain moving forward. The biggest wildcard seems to be exactly how the Federal Reserve will continue to respond to inflation. It has already been decided to raise rates beginning this quarter as well as to aggressively taper off their bond repurchases. The decision rattled markets who were accustomed to the low-rate environment however it was certainly not a surprise move. My guess is if the above interventions have the desired impact on inflation, investors will be willing to move past the rate hikes, but we will need to wait and see.

What does this all mean? Investors should continue to closely monitor their positions and risk tolerance. If you were uncomfortable during the past month, you may want to use any upcoming rallies to reduce some of your equity exposure as it’s possible to see extended volatility. Most importantly, make sure your portfolio allocations have specific roles and that they are achieving them. Some equity funds are more volatile by nature than others so be clear about their purpose. Not all bond funds are the same so if you are looking for better principal protection you will have a good idea how they are performing in this current environment. As always, we are here to answer any questions you may have. We are happy to help. Stay warm and stay safe! See you in March!

Best,

Ashley Rosser, President

Ashley Rosser, President

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.

The Start of 2022 Signals Caution for Investors

Happy New Year! I hope the first few days of 2022 finds you and your family well. 2021 brought many challenges to our nation and it appears some of those challenges will follow us into the new year. Some of those challenges certainly impacted areas of the market, some positively, others not. Many investors are asking what to expect this year regarding this year’s stock market performance. One thing I definitely know is that no one ACTUALLY knows what the stock market will actually do in the future. What we can do is take the information we know to make informed decisions regarding our future investment actions.

Investors are still feeling overwhelmingly positively about the market and that is good for market returns in the short term. As investors continue pouring into equities the momentum will likely keep dragging markets higher. Much like a car rolling downhill in neutral, tapping the brakes initially doesn’t do much to curb the momentum. However, keep pushing on the brake pedal long enough, and the car will slow to stop. There are certainly “brakes” that exist in the current investment environment. Inflation may remain more persistent than anticipated which impedes consumption and compresses profit margins. The Federal Reserve has already began its taper of assistance and we will likely see rate hikes on the near horizon. Additional stimulus seems unlikely at this point, if we see any it will be widespread checks to households seen in 2020 and early 2021. This will probably lead to less liquidity in markets as Americans won’t have the “cash to burn” they did after other stimulus checks. Economic growth has shown some signs of stagnation.

In today’s changing environment, what should investors do? I believe the New Year is the perfect time to look over your portfolios and see if any changes should be considered. Do you know what positions you hold and more importantly do you know why? Every position should have a specified purpose. Is the allocation there for long term growth, to hedge against inflation, for principal stability, or to provide diversification from other portfolio positions? More importantly, is the allocation still working? If your answer is “no” or “I am not sure” this could be an important time to get those questions answered. If the position is not working now, investors should consider if it needs to be replaced. Investors should also understand that if we do see significant changes like what is outlined above then what has been working well for the past few years may not continue to. It is possible we will see a rotation from growth to value in the future, particularly if inflation continues to rise unchecked. It is also quite possible that what HAS been working for the past decade (growth, tech, etc) will also continue to reign supreme. As you remember regarding future market performance “no one knows anything” . We can only do our best to hedge our bets based on the information available. We will continue to use math and rules-based investing to find areas of positive momentum and growth for our clients in the coming year. If you have any questions about your current portfolio please don’t hesitate to reach out as we are always happy to help. Wishing you and your family a very happy new year!

Ashley Rosser, President

Ashley Rosser, President

Prior to her career in the financial services industry, Ashley earned her Bachelor of Science in Nursing from Cedarville University.

Ashley decided to make a career change from her ten years within the healthcare industry as a pediatric emergency room nurse to retirement and 401K investment planning. She joined Victory Wealth Partners in 2008 after obtaining her Series 65 professional financial license and went on to earn her AIF (Accredited Investment Fiduciary) professional designation from the Center for Fiduciary Studies.